SYDNEY and KUALA LUMPUR, Jun 21 (IPS) – After decades of rejecting international tax cooperation under multilateral auspices, rich countries have finally agreed. But, by insisting on their own terms, progressive corporate income tax remains distant.

Tax avoidance and evasion by transnational corporations (TNCs) are facilitated by ‘tax havens’ – jurisdictions with very low ‘effective’ taxation rates. Intense competition among developing countries to attract foreign direct investment (FDI) makes things worse.

Read the full story, “OECDs Regressive World Corporate Income Tax Reform”, on globalissues.org →

Three Truths to Address Sexual Exploitation, Abuse & Harassment in the UN

Three Truths to Address Sexual Exploitation, Abuse & Harassment in the UN  COP27 Fiddling as World Warms

COP27 Fiddling as World Warms  UN chief highlights crucial role of G20 in resolving global crises

UN chief highlights crucial role of G20 in resolving global crises  Somalia: Human rights chief decries steep rise in civilian casualties

Somalia: Human rights chief decries steep rise in civilian casualties  Ukraine: UN convoy delivers vital aid to residents of Kherson

Ukraine: UN convoy delivers vital aid to residents of Kherson  COP27: Week two opens with focus on water, women and more negotiations on ‘loss and damage’

COP27: Week two opens with focus on water, women and more negotiations on ‘loss and damage’  A new treatment could restore some mobility in people paralyzed by strokes

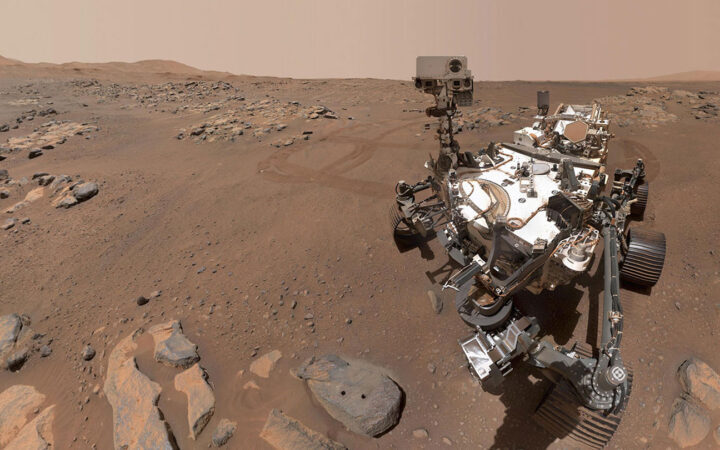

A new treatment could restore some mobility in people paralyzed by strokes  What has Perseverance found in two years on Mars?

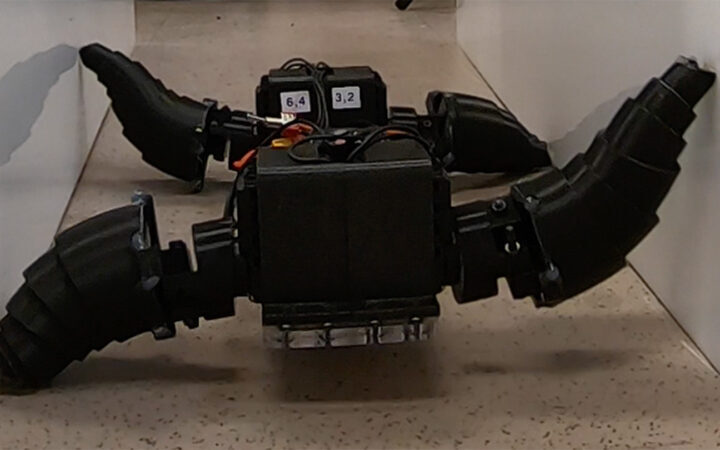

What has Perseverance found in two years on Mars?  This robot automatically tucks its limbs to squeeze through spaces

This robot automatically tucks its limbs to squeeze through spaces  Greta Thunberg’s new book urges the world to take climate action now

Greta Thunberg’s new book urges the world to take climate action now